Photo credit: DN Journal

In the good old days of PR – ah, I remember them well – measuring earned media was simple. Any media placement resulting from PR activity counted as a “win.” Just count the articles that contained any brand mention in the editorial content of print or news broadcasts.

If your employer used a media monitoring service like Bacon’s (now Cision), Luce, or Burrelle’s in the U.S. or Durrant’s in the U.K, you received a manila folder each week or month containing clips of your brand mentions. Clients received their clips anywhere from three days to three weeks after publication. Each clip had a tag affixed with the name, location, date of publication and circulation for each publication. Broadcast monitors like Video Monitoring Service (VMS) monitored live broadcasts and delivered a summary transcript of the broadcast clip with viewership numbers from Nielsen – and then tried to get clients to buy the audio/video clip or a full transcript. Nielsen data provided the number of viewers who were watching the broadcast segment.

In addition to the count of media clips, number of eyeballs (divided by 2) was the only PR metric that mattered. Add the circulation and Nielsen viewership numbers together and, voila, you knew the “reach” of your PR efforts. In fact, “reach” wasn’t actual “reach; it was POTENTIAL audience or VISIBILITY. More reach, it was thought, equated to greater impact (assuming the audience saw and read the mention).

In my experience, the C-suite loved to review that manila folder of print media and broadcast clips – and asked few questions about the real value of the articles. (The vast majority of them were positive; that’s how the business and trade press worked back then.)

Gosh, life in PR was good then — so simple and straightforward (with really good lunches at terrific restaurants).

To get some semblance of the VALUE of earned media placements, many organizations used advertising value equivalency (AVE). AVE reported how much an earned media article would cost if it were a paid advertisement in the publication where it appeared. The cost value was assigned on the basis of card rates for advertisements. Some companies or their PR agencies multiplied the card rate by 3 to 5x on the theory that editorial content – earned media – is that much more valuable than paid media (advertisements). Some public relations executives thought that the circulation numbers should actually be reduced in measuring PR because only a certain (undetermined) percentage of readers actually read the story and because many clips didn’t include the company’s key messages. Those PR executives pretty much kept silent (and still do).

The AVE metric was the accepted measurement standard for many years. Now, most professional organizations in PR condemn AVE as an invalid and inappropriate PR metric. That’s based on the fact that there are absolutely no studies equating the value of editorial content with the value of an advertisement. In addition, the advertising data used to determine AVE is often faulty or out of date. Few companies pay the listed card rates for advertising and advertising rates now change dynamically almost hourly based on supply and demand. Then, there’s the issue of how prominent the company or brand mention was in the article and the sentiment toward the company or brand. A passing mention in the fifth paragraph with a neutral sentiment certainly did not have the value of an advertisement that conveyed all the brand’s selling messages. Nonetheless, many organizations still demand that media monitoring services provide AVE for every clip. Some media monitoring and measurement services still do include AVE data even though they privately acknowledge it’s basically worthless as a metric for earned media.

Qualitative PR Measurement

So, PR measurement gurus like Katie Paine, Angie Jeffrey, Mike Daniels, Sandra McLeod and leading academics in PR like Jim Grunig and David Dozier worked hard to develop better metrics to analyze the QUALITY of earned media clips. They also served as evangelists to convince PR practitioners of the need for better metrics and measurement.

What should be measured? What metrics should be used? How should the results be reported?

The measurement gurus developed a set of qualitative measurements. The first was sentiment or tone. Was the article positive or negative? That, they said, revealed if the article improved or diminished brand reputation.

They also measured prominence and dominance. Was the brand mention prominently placed in the headline or first paragraph – or was it a mere mention? More prominence had higher value. Were competitors mentioned? Which brands were most prominently covered in the article?

They also analyzed articles for brand messages. Did the brand’s messages – features or competitive advantages – appear in the article? How many messages and how prominently?

The evolving metrics aimed at measuring the QUALITY of the earned media coverage. Did it appear in the right publication? Was it positive? Did it deliver the right messages? Did it position the company or brand well compared to competitors?

Those new media measurement approaches were certainly a step forward in analyzing VALUE of earned media mentions – even if they didn’t put an actual number on the value. Most all those PR metrics remain in place today and are part of most media measurement services.

The leaders in PR measurement also started evaluating PR value in relationship to business goals. They started developing methods to measure the impact of earned media mentions on lead generation, sales and brand loyalty. Measuring the impact of earned media on business goals was in a nascent stage, when….

Along Came the World Wide Web

In the late 90s, some print publications started to publish their content on the Internet. PR pros saw the added eyeballs on the Web as a “bonus,” but they couldn’t determine the size of the bonus. The publishers didn’t reveal the number of people who accessed their websites or specific articles (they still don’t, though they do reveal “impressions” to advertisers for billing purposes).

Start-up companies such as CyberAlert, Custom Scoop and eWatch (sold to PR Newswire) developed innovative new online media monitoring services to aggregate all the news stories published each day, index the content, and query the index with keywords of clients. The online services deliver clips via email to clients the next morning or even faster. The services also store clips in an online database archive, allowing clients to access, search, sort, share and measure their clips through a digital dashboard.

Initially, the online news monitoring services didn’t include any viewership or “circulation” data because none existed. Then, services such as ComScore, Alexa from Amazon, and Compete developed varying systems to measure traffic on web sites. The only problem was that each service reported substantially different traffic numbers for the same web site. They still do. But, for most clients, the reported traffic number is “good enough” and media monitoring services supply traffic data with the delivered clips. Even now, the data is for the website in general, not the individual page or article – so the data reports “potential audience”, not actual visibility or impressions. (Publishers don’t supply data on “page views” to outside organizations, partly because the data they capture in their log files may be seriously flawed (but that’s for another article).

In their early days, online news monitoring services monitored about 2,000 news sources worldwide. As more publishers adopted the Web, the online monitoring services quickly grew to monitor over 40,000 news sources including newspapers, consumer magazines, trade journals, wire services, and online-only news sources in most all languages. (In spite of the demise of many traditional print publications, the number of online news sources that publish original content continues to increase steadily each month and most online news monitoring services today monitor over 60,000 news sources each day.) Today, most all traditional print publications publish their content on the Web (medical journals are an exception) and online news monitoring has become “best practice” for PR monitoring and measurement. While some media monitoring services continue to provide monitoring of print publications, a declining number of client organizations order print monitoring; online news monitoring meets most all PR measurement needs, is faster, more flexible and less expensive.

Once again, monitoring and measurement of earned media had become simple and straightforward through digital technology.

Enter Social Media

Social media put an end to simple and straightforward. Social media made PR and measurement REALLY complicated. Suddenly, measurement experts had too many different types of earned media, too much data and too many metrics. They had too many answers and no answers.

Earned media was no longer defined as brand mentions that appeared in publications, news broadcasts and the websites of traditional publishers. Now earned media came in dozens of different forms on many different social media networks. Some like MySpace died, but many like Facebook, LinkedIn, Twitter, Google+, and Pinterest emerged as communications titans with more subscribers than any traditional news publication – more subscribers in fact than the Top 100 news publications combined.

Many PR people were slow to recognize the importance, influence and impact of social media – but slowly they adapted, placing articles/posts in blogs and participating actively on social media networks. PR became actively engaged in social media marketing and content marketing. PR also took on some level of responsibility for owned media such as the corporate web site.

Leaders in PR evaluation and media intelligence started to try to figure out how to measure the results of their social media efforts. Social media enabled people to express their likes, to share articles, and to comment on articles.

Ah, ha. That’s what we should measure, they reasoned. It opened a whole new realm of PR measurement – engagement instead of placement or visibility. That approach has evolved into more advanced and integrated measurement methods and, today, databases are overflowing with earned and social media data.

How can PR practitioners make sense of the plethora of possible earned media metrics and measurement strategies? PR industry groups have published a number of documents to guide PR practitioners.

• The Barcelona Declaration for Measurement Principles, a set of seven voluntary guidelines established by the public relations (PR) industry to measure the efficacy of PR campaigns, was published in 2010 and outlined a basic philosophy or code for media measurement and established the basis for new standards.

• The Conclave, a broad coalition of Industry Associations, PR and Social Media Agencies and client companies, published the Complete Media Measurement Standards in June 2013.

• The Coalition for Public Relations Research Standards is expected to release its recommendations within the next few months. In the meantime, The Institute for Public Relations published Measurement Standards: Do’s and Don’ts for PR Practitioners by David Geddes, a member of the Coalition, outlining the standards on which the participating organizations have agreed.

Principles of PR Measurement

Most PR and marketing experts in measurement seem to agree on four key measurement principles:

1) Establish measurable goals on what you want to accomplish through earned media.

2) Measure the impact of earned media against those goals.

3) Use metrics that are specific to each goal

4) Use both qualitative and quantitative metrics for best insight

PR measurement attempts to answer one universal question: How successful is our PR? (PR now includes media relations and other traditional PR activities, content marketing, and social media.) You can still answer that question simply by citing the number of earned media clips, as we did in the old days. Or you could use broader and more rigorous criteria.

What you want to learn from PR measurement is:

• Are we getting the organization’s messages out?

• Is the target audience getting the message?

• Are implied or actual calls to action getting response?

• What business impacts are the communications programs producing?

• Are we doing better than we did in the past?

• Are we meeting our goals?

Setting PR & Measurement Goals

Different PR activities have different goals. One set of PR communications may be intended to fulfill financial reporting requirements, improve investor/analyst perception of the company, and increase stock price. Another set of communications may be aimed at generating leads and new customers. Another may be to build corporate reputation in order to improve staff recruitment among recent college graduates. Another common goal: increase traffic to the company or brand website.

Here are examples of other measurable PR and social media goals:

• Increase positive awareness of the organization and its key messages

• Amplify brand messages

• Build relationships with influencers

• Increase traffic to website or store

• Increase sign-ups (e.g. newsletter, white papers, product bulletins)

• Increase sales leads

• Increase transactions

• Reduce claims or customer-service calls

• Strengthen brand preference or loyalty

• Improve search engine results for specific key words

• Increase engagement in social media (followers, likes, comments)

• Establish or enhance executive influence

Matrixes of Metrics to Measure Earned Media

Organizing the business and PR goals into categories can be helpful in devising appropriate metrics – and measurement gurus have invented a number of schemes. Most were devised to measure social media – but can be applied to all earned media.

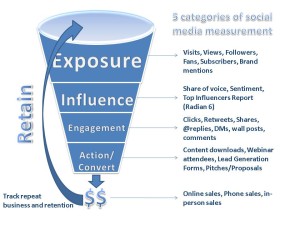

Early in 2010, Nichole Kelly proposed 5 Categories of Social Media Measurement, depicted in a graphic that portrays a sales funnel.

“Exposure” essentially measures old-fashioned “visibility” using data specific to social media.

“Influence” is similar to the qualitative metrics (e.g. sentiment, messages) of old using additional social media data.

“Engagement” measures audience reaction to PR outputs.

“Actions” measures things consumers do to move toward a purchase decision.

In a recent Kissmetrics blog post, Dr. Jenn Derring Davis of Union Metrics, the company behind TweetReach, offers a somewhat different five-part categorization: volume, reach, engagement, influence, and share of voice.

In a lengthy and thoughtful blog post on Occam’s Razor that has generated over 90 pages of comments, the digital evangelist Avanash Kaushik creates four categories of social media measurement:

• Conversation Rate: The number of audience comments per post. Measures the extent that the audience connects with what the company or brand is saying. A high conversation rate indicates that the audience perceives value in the social media content. (Easy to measure; data readily available.)

• Amplification: Social media amplifies content through sharing. Amplification measures the rate at which your followers on the various social networks share your posts with their networks. (Difficult to measure across all networks; difficult to aggregate data.)

• Applause: Aggregates and measures endorsements — the number of positive reactions such as Favorites, Likes, 1+. (Data readily available and easy to aggregate on owned media; more difficult to aggregate at the second level of endorsements on social media owned by others.)

• Economic Value: Measures the business outcomes of social media efforts. Examples: leads, new business, membership growth, new donors. (Both easy and impossible. With proper planning and cooperation of other internal departments, easy to obtain data on ecommerce actions. Almost impossible to obtain retail store outcomes, except for use of electronic coupons.)

The Valid Metrics Framework from AMEC developed what purports to be a simple way to align goals and metrics along a continuum of awareness, knowledge/understanding, interest/consideration, support/preference, and action. The matrix is well worth perusing, but be forewarned it requires 18 Powerpoint slides to display all of it.

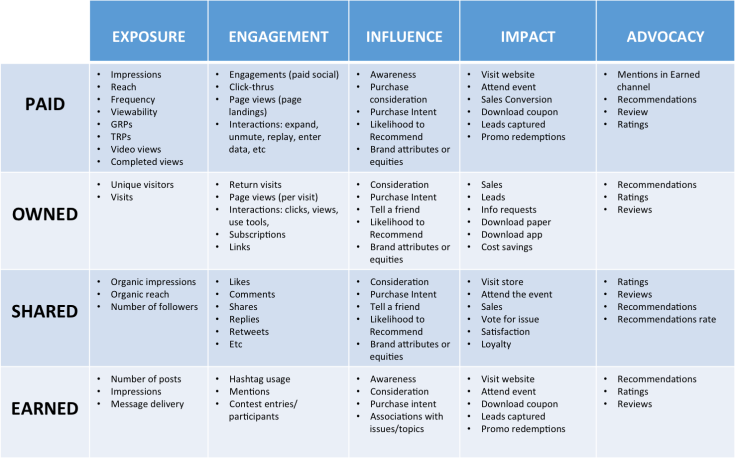

The late Don Bartholomew of Ketchum published a simplified goals/metrics matrix for paid, owned, shared, and earned media to measure exposure, engagement, influence, impact and advocacy. Here’s the MetricsMan Matrix:

Curata, a content marketing platform, recently issued an Infographic depicting 29 Vital Metrics to Measure Content Marketing Success in seven categories:

1. Consumption

2. Retention

3. Sharing

4. Engagement

5. Leads

6. Sales

7. Production/cost.

Each of the 29 metrics (“That’s too many!” says Katie Paine) includes the media type(s) where the metric applies. The matrix does not include a metric for measuring news coverage.

Measurement of PR Outputs

At the risk of incurring the wrath of the entire PR measurement establishment, I’d also add one additional metric to include: PR Outputs.

Long criticized by PR measurement experts as a worthless metric, work output is a measure used for almost every other job. Why not PR? Work output is a measure of staff or agency productivity. Granted, a PR department or agency may be spinning its wheels by putting out a lot of PR crapola or it may be producing just a little high-quality material that produces high levels of audience response. The point is this: properly measuring raw PR output can provide a good sense of staff productivity. More importantly, PR outputs affect conversation and amplification rates; mapping PR outputs against measures of volume and engagement can provide deeper insight into the quality and value of the PR efforts.

Metrics Applied to Specific Goals

In applying all these media metrics matrixes (I couldn’t resist), a key point is:

Different goals and PR activities require different metrics.

Aside: Metrics for PR measurement are sometimes called key performance indicators (KPIs).

Let me repeat, measuring different goals requires different metrics.

• Volume goals for visibility or engagement require volume metrics.

• Quality goals require qualitative metrics.

• Reputation and influence goals require perception/belief metrics.

Stated slightly differently, the goal determines the metric.

Measure what you are trying to accomplish.

No company should use all available metrics. There are too many and many are essentially worthless in measuring the “how are we doing” of PR and social media marketing. Each company needs to select those metrics that matter explicitly to their specific goals.

Choosing the Right Metrics for Each Goal

In digital media monitoring and measurement, volume and actions are the easiest metrics to capture and measure. More importantly, they provide real insight. Number of traditional earned media clips and opportunities to see/potential impressions trending over time – the old standby metric — still provides useful insight into how well your message is getting out. The data has credibility as a reputation management tool especially when clips are evaluated for sentiment and messages. This is true of both news and social media.

Measuring actions often correlates well with meeting business objectives. How many people linked from your earned media placements to sign up for promotional items? How many of those individuals became customers? What was their sales volume? All that information can be tracked by using specific links in your earned media placements to promotion pages and then following the sign-ups through the company’s CRM and ordering systems. Demonstrating conclusively through data that PR activities delivered leads and sales earns recognition all the way up the organization chart; following those leads through to sales orders credits PR for its direct contributions to meeting business goals.

Tracking combined engagement volume and actions metrics in social media provides a reasonably good understanding of the effect social media has on relationships, reputation, and business growth.

Standards for Assessing Media Mentions

In practice, few companies perform the actual assessments of media mentions themselves; they outsource the task to measurement services. The better outsourced services use standardized assessment criteria as outlined in the now-approved Proposed Interim Standards for Metrics in Traditional Media Analysis from the IPR Measurement Commission. Company PR staff in charge of hiring and supervising the measurement services should have a basic understanding of the standards and determine if their measurement service follows the recommended approaches for assessing media mentions.

Coming Media Measurement Innovations

To measure earned media, most large-ish companies subscribe to a media measurement service. The commercial measurement services offer a package of standard metrics or key performance indicators (KPIs) to evaluate PR outcomes. The fixed package rarely meets the specific needs of most clients. The KPIs are not suitable – and more importantly the metrics aren’t mapped against the company’s goals. However, most companies accept the packaged KPIs and their eye-catching graphics as “good enough.” Some companies subscribe to multiple media measurement services in order to get all the metrics they want.

The next major innovation in PR measurement will be customization of metrics and measurement systems to the specific goals and needs of each client. Clients will get to choose the metrics they want from a large menu of metrics that measure news coverage, content marketing, the full range social media of social media, and the company web site(s). The metrics will include both quantitative and qualitative measurement of all media. Clients will also get to organize and format the online dashboard and reports to their own liking. The reports will integrate results from all media and provide real insights into the overriding question “how are we doing” against the company’s specific goals. That’s the immediate future of PR and social media measurement.

CyberAlert expects to be the first media monitoring and measurement service to announce such a comprehensive, fully-integrated and completely customized PR and social media measurement service very shortly.

What do you think? What changes and new features would you like to see in PR measurement services?

Get Your Free Copy of the CyberAlert PR Measurement Handbook for in-depth analysis of today’s measurement standards, metrics and methods for news and social media.

William J. Comcowich founded and served as CEO of CyberAlert LLC, the predecessor of Glean.info. He is currently serving as Interim CEO and member of the Board of Directors. Glean.info provides customized media monitoring, media measurement and analytics solutions across all types of traditional and social media.

Trackbacks/Pingbacks